Attributed to high demand for high purity oxygen from a range of end-use industries, currently, the global high purity oxygen market accounts for nearly one-third of the global industrial gas market. Most demand has been driven by the steel industry, in which, over three-fourth of the steel is produced using high purity oxygen. Apart from the steel industry, the chemical industry has experienced higher growth as compared to other end-use segments. Growing demand for high purity oxygen in the chemical industry to increase reaction rate and yield efficiency will amplify market growth during the forecast period.

These aforementioned factors are projected to fuel the global high purity oxygen market at a CAGR of 6%, surpassing a market valuation of US$ 44.5 Bn by 2030-end.

Key Takeaways from High Purity Oxygen Market Study

- Industrial grade has remained the primary grade consumed by end-use industries, currently accounting for over three-fourth of global consumption.

- On the basis of supply, developed countries such as the United States, Germany, France, Belgium, the U.K., etc., are moving towards pipeline networks, which will drive this segment at a leading growth rate of 5% in the global high purity oxygen market.

- Metal production and fabrication have driven the consumption of high purity oxygen during the historical period.

- The medical & healthcare segment is set to create an absolute $ opportunity worth US$ 2 Bn by 2030.

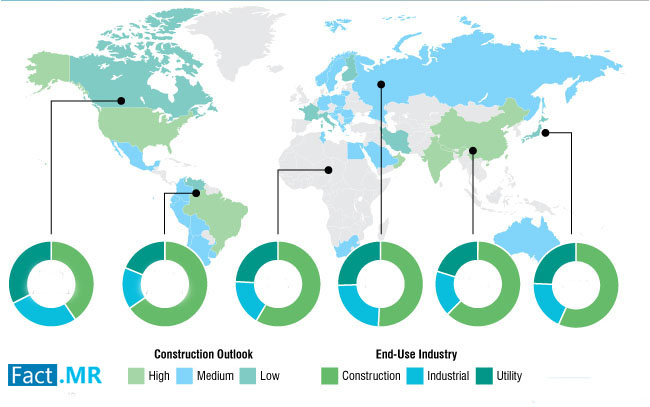

- China, being the largest steel and chemical producer, has driven the consumption of high purity oxygen, and currently accounts for over one-third of global consumption.

“The uncertain COVID-19 outbreak has skyrocketed the demand for medical grade oxygen, and this segment is poised to generate over 4 to 5 times more demand in 2020 as compared to 2019,”

says a Fact.MR analyst.

Widespread Gas Pipeline Network Emerging As Key Strategy of Market Titans

Increasing demand from end-use industries in order to sustain high profit margins in this competitive market, industrial giants have established huge pipeline networks to provide fast services to their consumers. This will not only help suppliers in the high purity oxygen market to maintain their margins but also provide end users with continuous reliable supply. For instance, Linde has established a pipeline network in its core regions, and in result, it supplies reliable and economic industrial gases to its high-end consumers. In order to align with this market trend, Taiyo Nippon Sanso Corporation successfully established a new underground piping network in 2019, which spans 20 kms in Vietnam’s southern region.

More Valuable Insights on High Purity Oxygen Market

Fact.MR, in its new offering, presents an unbiased analysis of the global high purity oxygen market, presenting historical demand data (2015-2019) and forecast statistics for the period of 2020-2030. The study divulges essential insights on the high purity oxygen market on the basis of grade (industrial, medical, electronic, and others), supply (onsite & pipeline, merchant & bulk, and packaged), and end use (metal production & fabrication, chemicals & refinery, medical & healthcare, electronics, glass & ceramics, pulp & paper, and others), across five major regions.