In this Finflow-x review, readers will gain insight into this web broker and the services it offers. A web broker essentially serves as a platform for online trading in various financial markets, enabling individuals to engage in the buying and selling of assets such as Forex, Indices, Cryptocurrencies, Stocks, NFTs, and Commodities. These platforms act as intermediaries, connecting traders to global financial markets.

Finflow-x, like many web brokers, offers multiple services to its clients. These services encompass diverse trading account options tailored to different needs, access to daily financial news and updates, an education centre aimed at enhancing traders’ skills and knowledge, 24/5 customer support for assistance, a mobile application for convenient trading on the go, and advanced security measures, including encryption, to safeguard users’ sensitive information.

The subsequent sections of this article delve into the details of the services provided by the firm, offering a comprehensive understanding of their features and functionalities. By exploring these aspects, readers can make informed decisions regarding whether Finflow-x aligns with their trading objectives and preferences.

Finflow-x Review: What Types of Accounts Does Finflow-x Offer, and How Can You Open Them?

This part of the Finflow-x review will discuss the accounts offered by this broker and their account opening process. Finflow-x offers different types of accounts depending on your trading needs. These include Basic (€1500), Silver (€25,000), Gold (€50,000), Platinum (€150,000), and VIP (ASK YOUR ACCOUNT MANAGER) accounts.

Each account type has different features and benefits, such as leverage, spreads, commissions, trading signals, and educational resources. You can compare the account types on the Finflow-x website and choose the one that suits your goals and budget.

To open an account with Finflow-x, simply visit the Finflow-x website and follow the account opening process that takes less than five minutes. You will need a valid government ID to open an account. You can also choose a currency and deposit method. Finflow-x accepts various payment options, such as credit cards, e-wallets, and bank transfers. After you make your first deposit, you can start trading on the Finflow-x platform.

What Purpose Does Finflow-x’s Daily News Service Serve?

This Finflow-x review explores the significance and function of the broker’s daily news service. The provision of daily news is a common feature among many web brokers, and its primary purpose is to offer traders access to timely and relevant information about financial markets. This information can include market trends, economic events, geopolitical developments, and company news that may impact asset prices.

Finflow-x, in line with industry standards, provides its clients with a daily news service to keep them informed and updated about events and trends that could influence their trading decisions.

By offering this daily news service, Finflow-x seeks to enhance the trading experience for its clients.

What Does Finflow-x Offer in Its Education Center?

An education centre is a valuable resource provided by web brokers to assist traders in enhancing their knowledge and skills in the world of financial markets. Finflow-x, in line with industry standards, offers an extensive education centre to support its clients in their trading journey.

The education centre provided by Finflow-x encompasses multiple educational resources, including webinars, e-books, and trading guides. These resources are designed to cater to traders of different experience levels, offering valuable insights and knowledge on various aspects of trading.

One notable feature of the education centre is its collection of video tutorials, categorized into beginner, intermediate, and advanced levels. These tutorials cover unique topics, including fundamental concepts like basic forex education and stock market introduction, as well as more advanced subjects such as Fibonacci, forex indicators, timing in forex, and advanced trading tools and techniques.

The education centre of Finflow-x is designed to help traders of all experience levels enhance their trading performance and achieve their goals. By using the education centre, traders can learn new skills, update their knowledge, and gain insights from professionals.

Finflow-x Review: 24/5 Customer Support

In this Finflow-x review, this section examines the significance of 24/5 customer support at web brokers and the type of customer support this broker provides. Customer support is a crucial component of the services offered by web brokers, as it plays a pivotal role in addressing trader inquiries, concerns, and issues promptly and effectively. While trading in financial markets, access to solid customer support during trading hours can be essential for traders who may encounter technical glitches or require assistance with their accounts.

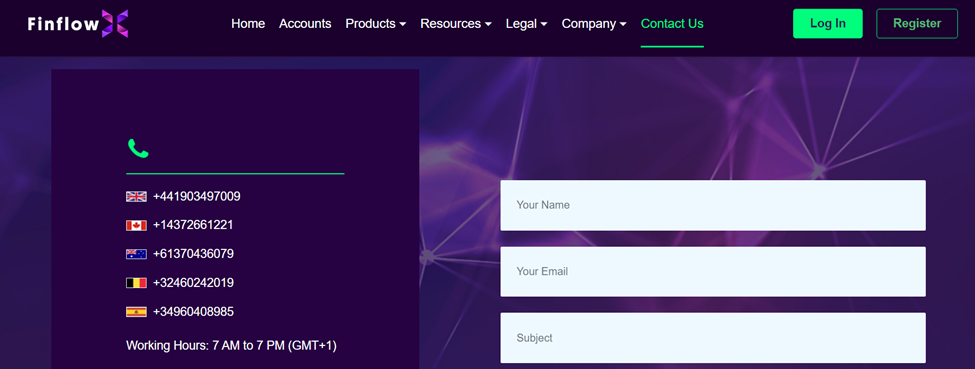

Finflow-x recognizes the importance of responsive customer support and provides it in multiple languages, including English, Spanish, German, French, and Italian. The support team operates during trading hours, from 7 AM to 7 PM (GMT+1), to align with market activity. Traders can reach Finflow-x’s customer support through phone lines dedicated to various regions, including the UK, Canada, Australia, Belgium, and Spain. Additionally, traders can also contact support via email at support@finflow-x.com.

How Does Finflow-x Facilitate Trading with its Platform and Mobile App?

This Finflow-x review explores the broker’s trading platform and mobile app, integral tools for traders in the digital age. The trading platform is accessible through the Finflow-x website and terminal, offering traders a user-friendly interface to execute their trades efficiently. This broker provides access to six financial markets, including Forex, Indices, Cryptocurrencies, Stocks, Commodities, and NFTs.

In addition to the web-based platform, Finflow-x offers a mobile app that makes the accessibility of trading platform on the go easier. The mobile app is compatible with various devices, making it convenient for traders who need to monitor their portfolios and execute trades while away from their computers.

The combination of the trading platform and mobile app ensures that Finflow-x clients have access to their accounts and the financial markets at their fingertips, providing flexibility and convenience in their trading activities.

How Does Finflow-x Ensure Advanced Security and Encryption?

In this Finflow-x review, this part focuses on the critical aspect of advanced security and encryption measures employed by the firm to safeguard clients’ personal and financial information. Security is a paramount concern for traders in the online trading environment, and Finflow-x takes proactive steps to address this concern.

To ensure the protection of sensitive data, Finflow-x utilizes state-of-the-art security technologies, including SSL (Secure Sockets Layer) encryption. SSL encryption is a robust cryptographic protocol that encrypts data transmitted between the trader’s device and the Finflow-x servers. This encryption helps prevent unauthorized access and data breaches.

Furthermore, Finflow-x enhances security by implementing two-factor authentication (2FA). This method of security requires users to provide ID and Address verification before accessing their accounts, adding an extra barrier against unauthorized access.

Is there an option of Leverage Trading?

This Finflow-x review also delves into the leverage options provided by the firm, a crucial aspect of trading that can significantly impact traders’ strategies and risk management. Leverage allows traders to amplify their positions, potentially increasing profits but also carrying higher risks.

Finflow-x offers varying maximum leverage levels depending on the trading instrument and the type of account chosen. The typical leverage offered by the broker is 200:1, reflecting the industry standard for many trading instruments.

For traders with Basic, Silver, and Gold accounts, the leverage is capped at 1:25. Platinum account holders enjoy higher leverage, set at 1:100, while VIP account holders have access to the maximum leverage offered by Finflow-x, which is 1:200.

It’s important for traders to understand the implications of leverage on their trades and risk tolerance. While higher leverage can amplify profits, it also magnifies potential losses, making risk management a critical consideration in trading with leverage.

Finflow-x Review: What Limitations Does Finflow-x Have?

Finflow-x, like any brokerage firm, has certain limitations that traders should be aware of when considering its services. These limitations include:

- Limited Language Options: Currently, Finflow-x’s website is available in only two languages: English and Spanish. This may pose a barrier for traders who prefer to conduct their trading and research in other languages.

- No PayPal Support: Finflow-x does not accept PayPal as a payment method. While the broker offers other payment options, the absence of PayPal may inconvenience traders who rely on this popular online payment platform.

It’s important to weigh these limitations against the firm’s advantages and the individual trader’s priorities when choosing a broker.

Finflow-x Review: Ending Remarks

In conclusion, Finflow-x offers a range of services in the online trading industry, providing access to various financial markets, educational resources, and customer support during trading hours. The firm employs advanced security measures to protect clients’ personal and financial information. As seen in our comprehensive Finflow-w review, its trading platform and mobile app cater to traders seeking flexibility and convenience.

Disclaimer: This content is not intended to advocate or endorse. The author bears no responsibility for any subsequent consequences of the company’s actions throughout your trading journey. The reliability and modernity of the data contained in this discourse may be questionable. All trading and financial determinations rest exclusively on your shoulders, without placing trust in the information provided herein. This platform denies any warranties pertaining to the accuracy of its content and shall not be held liable for any trading or investment losses.